Managing Personal Finance – Do’s and Dont’s

“Zero Percent EMI”,

..

..

“5% cashback on payment through XYZ credit/debit card”,

….

…

“MutualFundsSahiHai”,

all these ads which we have commonly seen, have one thing in common. Aggressive marketing of financial instruments to retail consumers to aid spend or investment.

NBFCs and Mutual Fund companies have been trying to build strong distribution network across the country to sell their products to retail consumers. On the investment side, the popularity of products such as mutual fund among retail investors has increased manifold which is evident from mutual fund inflow data released by AMFI (For more details refer to one my previous posts. On the other hand, the use of financial products such as credit cards, EMI cards (by Bajaj Finance), etc. to buy consumer durable goods has also gained traction. Therefore, the awareness about financial products has increased substantially over the last few years especially in the urban India.

Financing your purchases through short tenure loans has never been so easy

Most of organised retail stores in the metros today have tie-ups with Bajaj Finance, Capital First and HDB Financial services to fund your purchases. Further, many of them have tie-ups with credit card players for easy EMIs Therefore, in today’s age funding your capital requirements from any of the banks or NBFCs is a largely seamless process especially for the working class population. The millenials today are also not averse to fund their capital requirements through debt to even buy a electronic products (mobile phones, laptops) or for leisure travel.

Though funding your capital requirements through credit cards or EMIs is a good option as it provides you with short-term liquidity, in many cases it also leads to beginning of a fall into the “Debt Trap”. A “Debt Trap” is a situation where an individual has to continuously undertake debt for an extended period of time to repay previous debts, due to high interest rate at which initial debt was raised. Therefore, it becomes imperative for everyone to ensure that the debt undertaken is low cost and benefits the individual more rather than the bank/NBFC.

Frenzy about investment into equity markets

India has traditionally been a physical asset oriented economy with real estate, gold considered to be primary investments. However, the rising awareness about financial products has aided mutual funds inflow among retail investors, which is a very good sign for the economy. However, many millenials also view equity markets as an easy way or shortcut to create money which is certainly not the case.

Therefore, with the increase in exposure of retail consumers to financial products also comes a looming risk of mismanagement of such products, as not everyone has in-depth understanding of such products despite general awareness. In-line with current trends, I have highlighted below few of the Do’s and Dont’s of personal finance which maybe adopted in your day to-day life:

Taking loans via credit cards

Most of us are aware of the high interest rates charged by the credit cards if an individual opts for EMI mode to fund a particular transaction. Despite this, many fall prey to this option as it is most convenient and a seamless option. Loan via credit cards is one of the easiest ways to get into debt trap. I have personally known many friends of mine who finally took recourse of a personal loan to fund their credit card loan. Unfortunately, they burn significant cash on high interest rate before coming out of this debt trap.

Therefore, avoid taking loans via credit cards unless the merchant/company is providing a productwith the EMI option. For example, if you are buying a product through Reliance Digital/Croma and the vendor is providing an zero-interest EMI option if product is purchased through XYZ credit card, then one may go for the same. The effective interest rate in such cases is low and borne partially by merchant or company. But avoid ‘convert to EMI’ option which is available on websites of the credit card companies. The effective annual interest rate rate in most of the cases in 25-30%.

Loan for buying a high-value depreciating asset at a young age

Buying a car (as it is aspirational and also a status symbol in many parts of country) at a young age despite little savings may give you a good kick, and make you feel rich even as it makes for a bad investment per se. The moment your car exits a showroom, its value depreciates by more than 40%. Further, the most bitter part is paying interest on the depreciable asset, which ideally could have been the amount you earned if invested in financial asset. So invest in car wisely taking into account the benefits such as time it will save for you and other related economics. Obviously, if one has passion for cars, everything above has to be ignored. The same goes for owning a high-end mobile phone.

As a thumb rule, I believe one should not invest in aspirational assets worth X unless he has created 2X worth long-term appreciating assets (financial assets, land, etc.). So if you have savings worth Rs 20 lakhs, financially there would be little harm in buy a car worth Rs 10 lakh.

Over-investing in stock markets through direct means (not mutual fund or advisory route) despite limited time to track your investments

Thanks to media channels and social media, stock markets today are portrayed to be the most easy way to generate wealth. Further, the upturn during from 2014 onwards has further created a frenzy among many young investors. Though generating 12-14% CAGR returns over the long-run is pretty much possible, most investors look for above 20% returns which requires a very professional approach and with ability to manage risk.

To set record straight – Your monthly salary is the most easiest money you can earn. Even if you are working for 16-18 hours a day, it is the most risk-free way of earning your living. Generating returns through direct investments in capital markets is not only very difficult but also in many cases not proportionate to the hardwork put in by the investor . However, if one is a long-term investor in real sense with more than ten years of horizon expecting 12-14% return, then the process should not be difficult. Sadly, long-term investment process is followed on twitter and blogs and not followed in real life.

Investing in any financial instrument for a quick buck despite limited or no knowledge

I remember how many of my friends were fascinated by the prospect of investing in “Bitcoin” last year and make a killing out of it. And many lucky ones, made lot of money as well. But there were equal number of people who either lost money, or were not able to liquidate their investments. However, nobody will ever share their failure stories and you will only hear about people generating abnormal returns.

Always cut through the noise and invest only in products that you understand. Ignore stock specific “tips” received from friends,colleagues,social media for short-term gains if you do not have understanding about the underlying risks. It is always more important to protect your hard earned wealth than trying to make quick buck in short run where risks are unknown to you.

Avail use of multiple credit cards

Building a good CIBIL score has become essential today in-order to secure loans at lucrative interest rates at a later stage in life. Systematic and disciplined use of credit cards with no defaults will help you build a good credit score. Also, it is important that you do not utilize the entire credit limit extended to you as it does not aid improvement in CIBIL score. A hack for the same (as per many secondary reports) is owing multiple credit cards with lower utilization % levels (spend/total limit) by diversifying spends across credit cards.

If credit card application is rejected, do not apply again in haste

The offers available on credit cards lure many into applying for the same. However, CIBIL score requirement and parameters for approval are different across players. For a first-time credit card applicant, approval might be not be possible due to non-generation of CIBIL score. In such a case, do not get impatient and apply with different credit card players, as it makes one look credit hungry (all your applications are being tracked). Apply for your first credit card with the bank which also houses your salary account, as the approval should not be a hassle in this case (unless you have an education loan with monthly ticket size exceeding 50% of your salary). Build a good credit card record and then apply for a credit card with better perks.

Invest in liquid financial assets from young age

For a professional residing in metros, it is invariably impossible to invest in real estate early in his/her career. Therefore, most of them need to stay in rented flats which is again a cash burn. However, during this period as well it is possible to create assets through investments in various financial instruments such as mutual fund, bonds, FD, etc. Investing in such instruments will also enable you to liquidate the funds in case of emergency. Further, once you create such assets it is also possible to opt for loans against this investments at a relatively lower interest rate. Therefore, even as your investment will continue to yield returns, you can use them to fund any emergency or one-time major expenses as well.

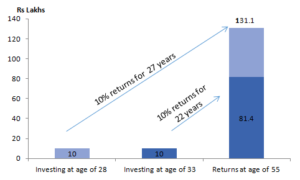

As illustrated below, Rs 10 lakhs invested at the age of 28 years would yield Rs 1.3 crore by the age of 55 assuming a modest return. However, if invested at age of 33, it would fetch you Rs 81 lakhs, which is around Rs 50 lakhs less. Therefore, it is important to give your money more time to compound in any asset class

Park some portion of funds in Government funds such as PPF

We are all aware of the tax benefits provided by instrument such as PPF. But alongwith with tax benefits, PPF is also one of the highest yielding debt instruments. Further, the returns on the same are not taxable which is not the case with investment in mutual funds, bonds, FDs. etc. However, on the other hand, it has lock-in of 6 years and therefore does not help in meeting your short-term expenses. The product acts as an excellent hedge against your investment in equity markets and will provide required cushion.

Maintaing Balanced Portfolio Mix

During a bull run, critical things like right portfolio allocation to different assets, mix of debt and equity, sector-wise exposure, takes a back seat as everyone is making money due to the hype. However, as Warren Buffet says “only when the tide goes out, you find out who is swimming naked”. Therefore, balanced portfolio mix (even while investing in different mutual funds) plays a very crucial role in navigating through difficult times in the market.

As per traditional portfolio allocation wisdom, “100-X” age should be the % allocation to equities and remaining in debt. However, this should again depend on an individual’s risk taking ability and short-term fund requirements

To sum up on investment bit, compounding (returns) is certainly the eighth wonder of the world as said by Einstein. And as history suggests, equities are best bet to generate superior returns. But, for the compounding wonder to work in equities one has to be patient, dedicate substantial time to research and have a disciplined approach towards investing. Else, #MutualFundsSahiHai perhaps is the best approach.

HAPPY INVESTING!