Ganesha Ecosphere – In Consolidation Phase; next leg of Growth from Q4 Fiscal 2021 onwards

Ganesha Ecosphere – one of India’s leading PET bottle recycler – recorded subdued set of Q2 Fiscal 2020 numbers. The revenue for the company dropped by 10% on-year basis, whereas the PAT increased by 17% on-year during the quarter aided by higher operating margins an lower financial costs. The company did not adopt the revised income tax rates announced by the Government on September 20, 2019 and is currently evaluating the option.

During fiscal 2019, the company’s top-line benefited from the commissioning of new plant at Bilaspur leading to 35% on-year growth in revenue during the fiscal. Therefore, the growth tapered off during H1 fiscal 2020. Kindly refer to initiation report of Ganesha Ecosphere for more details.

Quarterly Revenue and Margin Trend

The company recorded its highest ever operating margin of 13.1% during Q2 fiscal 2020 (without considering the Q4 numbers as they are difference between full year numbers and 9M numbers) which can largely be attributed to high capacity utilization and operational stability. The company is currently operating at maximum operating capacity.

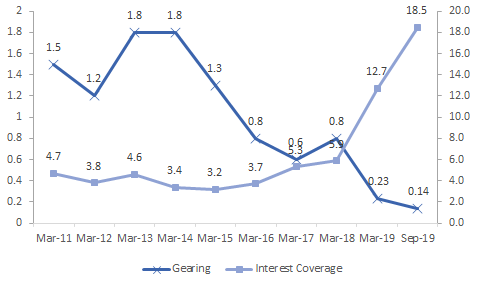

The Balance Sheet Strength for the company has improved substantially since fiscal 2015. From peak Gearing of 1.8X in March 2014, the leverage improved to 0.14X as of September 2019.

Trend in Gearing and Interest Coverage

The interest coverage ratio for the company has increased from low of 3.2X in Fiscal 2015 to 18.5X during H1 Fiscal 2020. The lower interest cost has also aided profitability for the company. However, the Gearing for the company is unlikely to further improve owing to its greenfield expansion plans.

Greenfield expansion of 35,000 TPA will be next driver of company’s growth

In December 2018, the company had announced its plans to increase installed capacity for PET Bottle Recycling by 35,000 Tons per annum (TPA), taking the consolidated recycling capacity to 1,43,600 TPA. The company has earmarked INR 250 Crore towards this expansion to be funded via mixture of internal accruals and debt. As of September 2019, the company had Cash reserves of INR 11.1 Crore and Liquid Financial Investments of INR 66.4 Crore. Assuming free cash flow of INR 100 Crore (conservatively) during H2 Fiscal 2020 to H1 fiscal 2021, the company will require to raise further debt of around INR 70-80 Crore. However, with reserves likely to touch INR 500 Crore by September 2020, the debt is unlikely to have substantial impact on balance sheet strength.

Post the commissioning of the greenfield project, the revenue for the company is likely to increase by more than 30% owing to increase in capacity.

Current Valuations and Investment Opportunity

The company is likely to report flat revenue and profit growth on-year basis during H2 fiscal 2020 and therefore expected to report around INR 70 Crore PAT

At conservative P/E multiple of 10X, the fair value for the company would be INR 700 Crore indicating 30% valuation upside from current levels (INR 540 Crore) in the short-term

Assuming PAT of INR 75 Crore for Fiscal 2021 (assumption: greenfield project commissioned in Q4, constant margins as fiscal 2020 and 20% uptick in long-term debt) and P/E multiple of 11X, the investor would generate IRR of around 35% (annualized)

On account of the impending subdued sentiment in the small-cap universe, the company is currently trading at very lucrative valuations (7.7X P/E) thereby providing very high margin of safety.

Further, post the ongoing greenfield expansion, the company is likely to see significant re-rating in its valuation multiple. The company will benefit from the full impact of its ongoing capex from H2 fiscal 2022. Also, the company has demonstrated its ability to scale up its new project expansion in the past. Therefore, the company makes a good case for long-term investment with huge upside potential and limited downside risk

Happy Investing!!

Readers are requested to do their own Research before investing in the stock. This is not a stock recommendation. The author of this blog is not a SEBI registered Investment Advisor.