M&M Financial Rights Issue: Desperate Move or Smart Maneuver?

The news of Right Issue by Mahindra & Mahindra Financial Services (“MMFS”) at INR 50 per share (1:1) in-order to raise INR 3,500 Crore hit the investors like a thunderbolt yesterday (18th July 2020). The issue price was at steep 76% discount on CMP of INR 208 for the company. This left many investors believe (including us) that the step was a desperate attempt by the company to raise funds on immediate basis to provision for huge losses from Q2 Fiscal 2021 onwards.

However, a closer look at the details of the transactions will make you realize that this isn’t a particularly desperate attempt by the company nor is the transaction very dilutive to the existing investors (considering current situation)

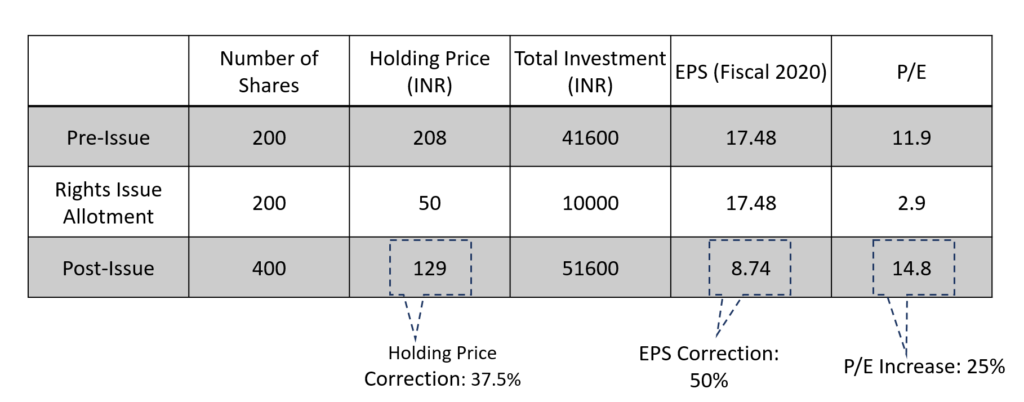

Let us consider a scenario for an investor holding 200 shares of the company holding shares at Current Market Price of INR 208

Scenario for an Investor Post-Issue

The holding price post-issue would drop to INR 129 for the investor and effective P/E on Fiscal 2020 basis will increase from 11.9X to 14.8X post-money, which is a 25% increase. Therefore, ideally there should a 25% correction in prices which will lead to post-money valuation (on P/E basis) being equal to pre-money valuation.

It is unlikely there will be such a steep drop in price on immediate basis as many investors would be would wait for the allotment through right issue. However, a high single digit correction certainly is a possibility. Also, the capital raise will improve the company’s capital adequacy situation to tide against the provisions and eventual losses due to Covid-19 Pandemic.

Now consider a scenario where company would have done 1:4 rights issue at INR 175 per share, a discount of 16% from Current Market Price. The fund-raise by the company would have been less by around 16% as compared to fund-raise under current structure. Though the dilution would have been slightly lower (at around 21%), the investors may not have been too keen to invest given the Covid-19 situation and possible headwinds in business at INR 175 per share.

Also, even 1:1 issue at higher value say INR 100 per share would have made many institutional investors jittery regarding the capital requirements of the fund apart from the downward rating due to a steeper value correction.

Investors would now have to either increase their stakes or quit the table

For an existing investor of M&M Financial Services, it would be almost criminal not to subscribe to the rights issue. If an investor chooses not to subscribe, his/her equity stake will be diluted by 50% leading to steep value erosion. Therefore, an existing investor SHOULD absolutely subscribe to this issue or sell before the record date.

To conclude, we believe the move will lead to volatility on the downside on Monday (20th July) and there may be a strong correction, which will likely get bought into by long-term investors gradually owing to interest in Rights Entitlement. This is a good step by the management which works in the interest of all stakeholders of the company for the long-run!

Buongiorno, articolo interessante. Noi siamo project-srl, offriamo soluzioni software avanzate per l’edilizia.

Se potrebbe interessarvi venite a visitare il nostro sito.

How Does Audible Work?

You take a trial of Audible and receive a complimentary audiobook.

This really is one of even an originals

or the classics.

At the conclusion of the trial, you can buy a monthly subscription of Audible.

You will need to sign up for the membership with your Amazon account.

Audible awards , Monthly. You can take advantage of this credit to buy

Audible audio books in various categories such as technology,

fashion, love, social networking, ads, etc..

You can purchase Audible credits or pay per sound publication, if you would like to buy more

books.

Interestingly, a member can download just two of six Audible

Originals. They don’t cost any credits. These Audible Originals can be kept by you eternally.

You have Audible audio books in your library even if you cancel your

subscription.

It’s possible to listen to Audible books anyplace using apps on Windows, your mobile or Mac computer or Alexa device.|

What is Audible?

With more than 300,000 titles to its name, Audible is the world’s largest seller

and manufacturer of audiobooks.

Audible Review https://hotchilis.net/is-audible-really-worth-14-95-a-month-yes-however-it-depends/

How Does Audible Work?

You take a trial of Audible and receive a complimentary audiobook.

This really is one of even an originals or the classics.

At the conclusion of the trial, you can buy a monthly

subscription of Audible. You will need to sign up for the membership with your Amazon account.

Audible awards , Monthly. You can take advantage of this credit to

buy Audible audio books in various categories such as technology, fashion, love, social networking, ads, etc..

You can purchase Audible credits or pay per sound publication, if

you would like to buy more books.

Interestingly, a member can download just

two of six Audible Originals. They don’t cost any credits. These Audible Originals can be kept by you eternally.

You have Audible audio books in your library even if you cancel your subscription.

It’s possible to listen to Audible books anyplace using apps on Windows, your mobile or Mac computer or Alexa device.|

What is Audible?

With more than 300,000 titles to its name, Audible is the world’s largest seller and manufacturer of audiobooks.

Audible Review https://hotchilis.net/is-audible-really-worth-14-95-a-month-yes-however-it-depends/

It might embrace late fee charges and different penalties.

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your site?

My blog is in the exact same niche as yours and my users would certainly benefit from

a lot of the information you present here. Please let me know if this alright

with you. Appreciate it!

Stop by my web site – bitumen Price