HDFC AMC – Aggressive Valuations for a Stable Elephant

Incorporated in December 1999, HDFC AMC operates as a joint venture between Housing Development Finance Corporation Limited (“HDFC”) and Standard Life Investments Limited (“SLI”). As of fiscal 2020, the company is the second largest AMC with quarterly average AUM of INR 3.7 trillion. It is the leader among Individual AUM segment (retail investors) with 15% market share as of March 2020, as per the company reports. As of March 31 2020, equity assets as a % of AUM was 38% for the company, compared to 48% in March 2019

The company operates through 221 branches. It has 9.4 million live accounts and a workforce of 1,194 people as of March 2020.

Before getting into further details about the company, let us get a sneak peek on the overall mutual fund industry

Industry Overview

- The Indian mutual fund industry story started in 1963 with the formation of UTI, a joint initiative of the Government of India (“GOI”) and the RBI in 1963. It was regulated and controlled by the RBI until 1978, after which the Industrial Development Bank of India (“IDBI”) took over

- Kothari Pioneer Mutual Fund (now merged with Franklin Templeton Mutual Fund) was the first private sector mutual fund in the country, started in July 1993.

- Post this, various mutual fund players entered the industry and as of fiscal 2000 there were 32 players

- As of March 2020, there were 43 players in the industry; however, the industry is highly consolidated with top 5 players enjoying 57% market share

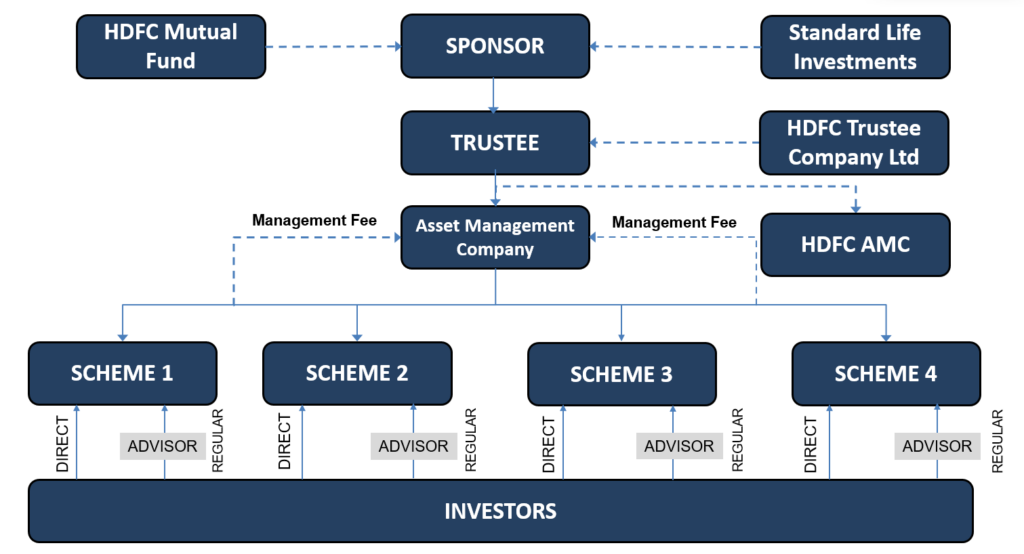

Structure of Asset Management Company

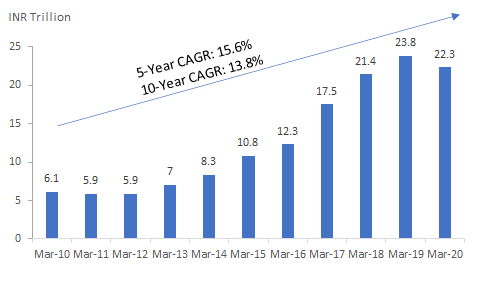

The AUM for the mutual fund industry has grown at 13.8% CAGR over the last ten years and 13.8% during the last five years

Trend in Industry AUM Growth

Note: AUM as on end of fiscal; Source: AMFI

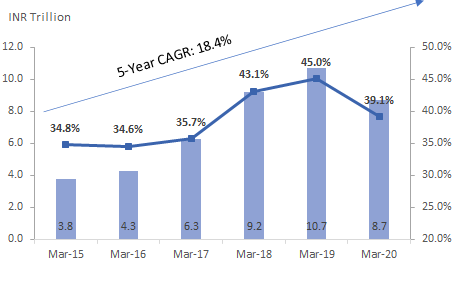

- The equity AUM increased at 18.4% CAGR during March 2015 to March 2020

- The drop during March 2019 to March 2020 was on account of outflows during February and March 2020 due to Covid-19

Trend in Equity AUM

Source: AMFI

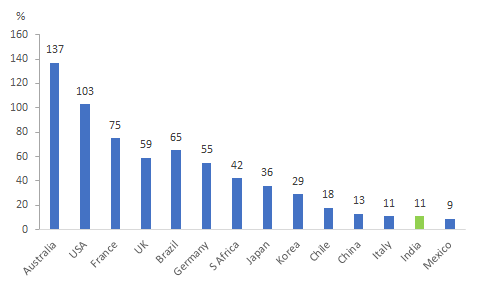

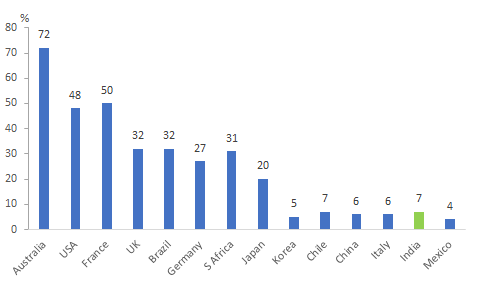

- The penetration of mutual fund industry is India is substantially lower as compared to its global peers

- The industry is still very young and provides a huge growth opportunity for the leading players in the industry

AUM as % of GDP low for India

Source: HDFC MF Presentation (January 2020)

Equity AUM as % of GDP

Source: HDFC MF Presentation (January 2020)

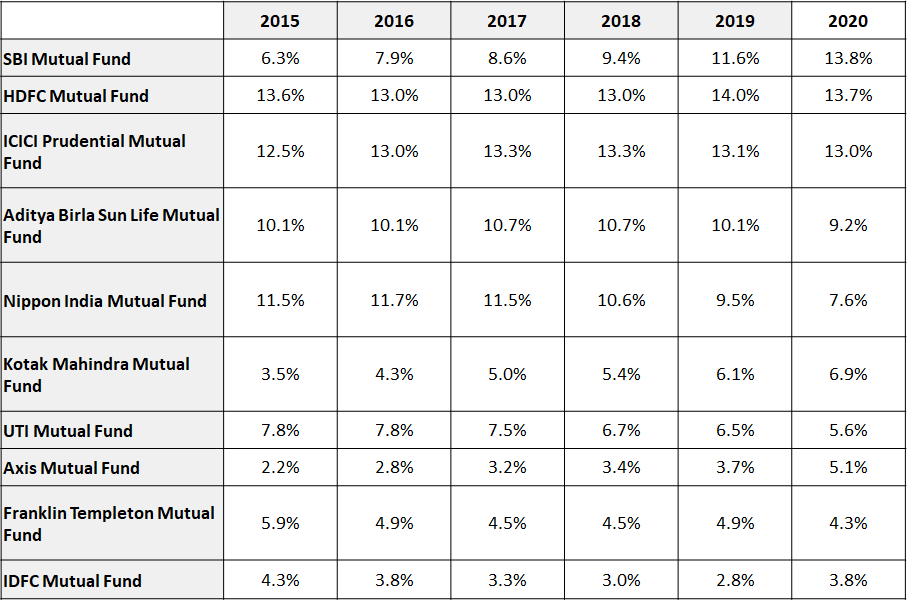

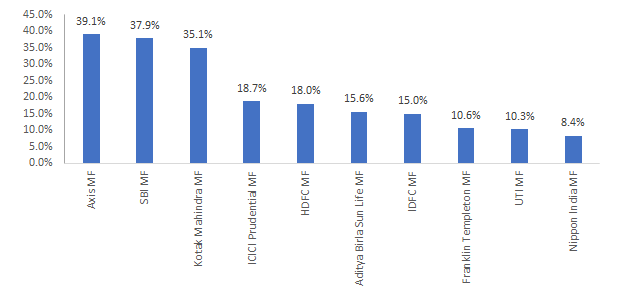

Market Share of top 10 players in the industry

Source: AMFI; Note: Basis Quarterly AUM numbers of Q4 of every fiscal

Among top 10 players, Schemes of Axis Mutual Fund have been the fastest growing over last five years

Source: AMFI

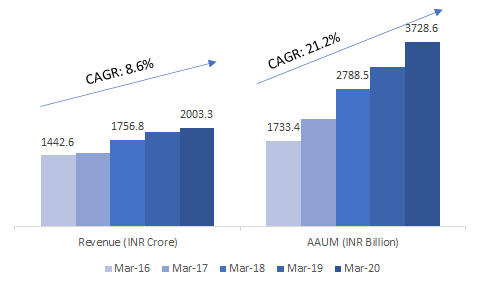

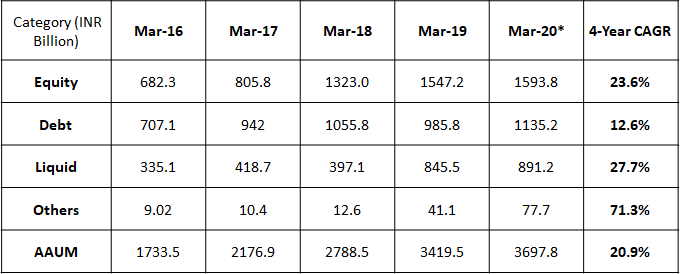

Strong AAUM growth, Modest Revenue Growth for HDFC AMC

- HDFC AMC has recorded robust 21.2% CAGR growth in its AUM during March 2016 to March 2020, slightly faster than the industry growth of 19% CAGR during the period

- However, increasing competition and tightening SEBI guidelines on expense ratios has led to comparatively slower revenue growth

Portfolio Growth across different categories

Source: Company Reports; Note: The numbers for March 2019 and March 2020 are basis QAUM

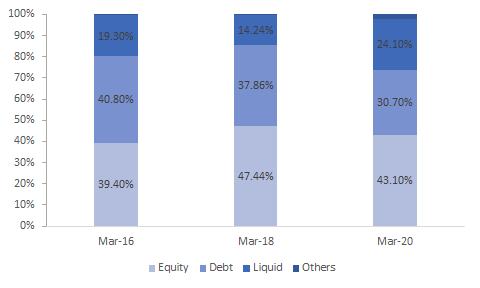

Trend in Portfolio Mix

Source: Company Reports

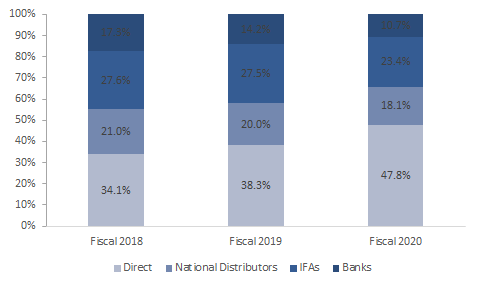

Distribution Mix: Share of “Direct” channel increasing

Source: Company Reports

- The share of direct channel has increased substantially from 34.1% in Fiscal 2018 to 47.8% in March 2020

- The increasing awareness among investors about mutual funds has aided the increase in share of direct channel; further, the share of direct channel is higher in debt and liquid funds where product differentiation is lower as compared to equity funds

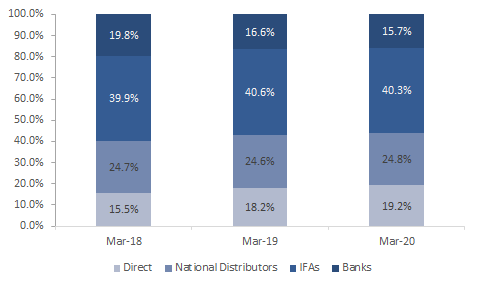

Distribution Mix: Share of Direct Channel in Equity AUM comparatively lower

Source: Company Reports

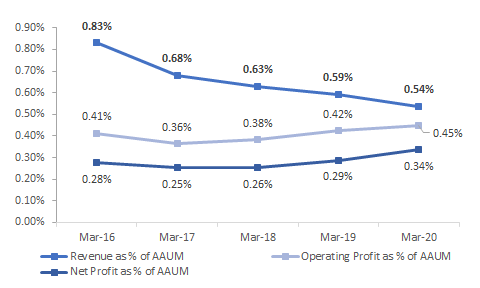

Trend in Revenue and Profits as % of AAUM

Source: Company Reports, AMFI

- The revenue as % of AAUM has dropped for the company due to change in SEBI regulations in September 2018 which mandated the company to pay distribution/commission from scheme TER (Total Expense Ratio) only

- Previously, these commissions used to flow in the company’s top-line (alongwith management fees) and were then recorded as distribution costs in the company’s direct expenses

- The change in regulations meant, both the above transactions were settled at scheme level only

“In terms of Regulation 52(1) of SEBI (Mutual Funds) Regulations, 1996, all

scheme related expenses including commission paid to distributors, by

whatever name it may be called and in whatever manner it may be paid, shall necessarily be paid from the scheme only within the regulatory limits and not from the books of the Asset Management Companies (AMC), its associate, sponsor, trustee or any other entity through any route.“

- The operating margin as % of AAUM for the company has increased consistently, as the drop in commissions due to change in SEBI regulations likely would have been higher than the drop in net revenue; however, it is difficult to validate the same as data at scheme level us not available with us

- The fees and commission expenses dropped from INR 327 Crore in fiscal 2018 to merely INR 20.9 Crore in fiscal 2020

- As an industry practice, asset management companies used to pay commission from the books of the Asset Management companies in-order to attract high AUMs; further, in many cases the commissions paid were higher than the trail earned from regular plans as compared to direct plans

- The above practice is no longer prevalent in the industry in-line with SEBI regulations

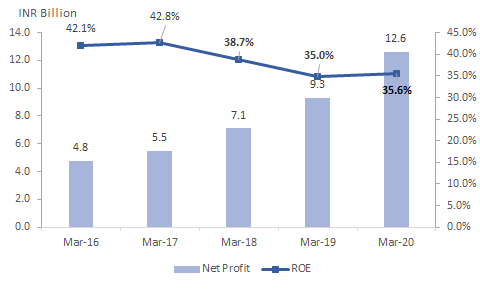

Healthy Growth in Net Profit over last five years

Source: Company Filings

- The net profit for the company was impacted in fiscal 2020 due to markdown in the company’s investment in NCDs of Essel Group through one of its schemes

- The company took hit of INR 120 Crore (~10% of reported profit) on AMCs books in-order to avoid steep losses to the scheme investors

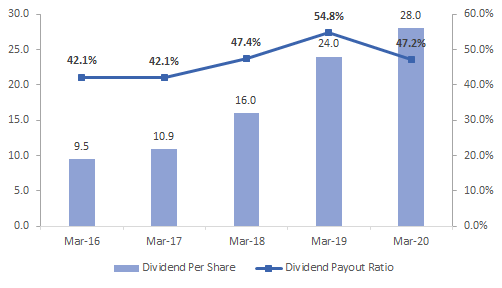

Trend in Dividend Payout by the company

Note: While calculating dividend per share across period, the number of shares have been adjusted for bonus and split for sake of accurate comparison

- The dividend payout ratio does not include the dividend distribution tax

- Therefore, the effective payout by the company to shareholders will further increase going forward due to change in the DDT norms announced in Union Budget 2020-21

- Even without correcting for increase due change in DDT norms, the dividend payout ratio for the company may eventually touch 75-80% as the company does not have any capex requirement

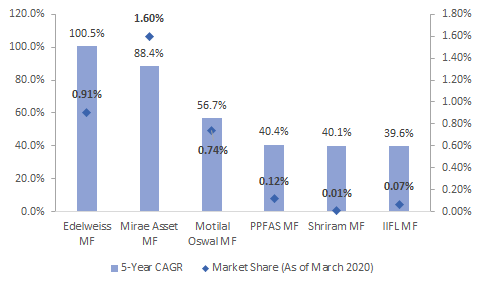

Larger players may face increased competition from smaller players in equity segment

- The SEBI regulation announced in September 2018 provides a level-playing field for all the AMCs

- Previously, the AMCs could have influenced the distributors to push their funds by payment of higher commission through the books of AMCs

- However, SEBI regulation on payment of commission only through scheme expenses will mean limited ability of larger funds with strong balance sheets to influence distributors

- Further, the increase in share of direct channel/online channel in sale of mutual funds will lead to fund returns and performance driving the sales rather than merely the strength of AMCs distribution channel

- PPFAS mutual fund, with merely 0.1% market share in the industry as of March 2020, has grown at 40% CAGR during the past five years

Fastest-Growing Fund Houses during last five years

Source: AMFI

- Investment Platforms like Kuvera, Paytm Money, Groww are providing gateway to invest in ‘direct’ funds of mutual funds; these platforms do not get any commissions from the mutual funds and would likely have to charge investor for the advise over the long-run

- These platforms will advise investors basis the returns of mutual funds and philosophy irrespective of the size of the fund

- Therefore, unlike in an industry like life insurance where strong banca channel ensure strong sales, the same may not be applicable to the mutual fund industry

- The sale of mutual fund products will become scheme performance driven; size of AMC balance sheet and strong banca, distribution channel will not remain the only levers of growth

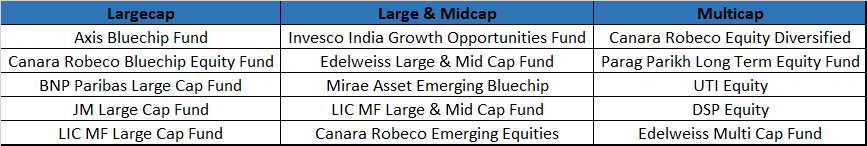

Top 5 Fund Performers across categories in equity segment

Source: AMFI

- The schemes of mutual fund are among the top 5 performers only in one category on 3-year CAGR return basis as of March 31, 2020

- However, past returns are not always the right indicator while making investment decisions

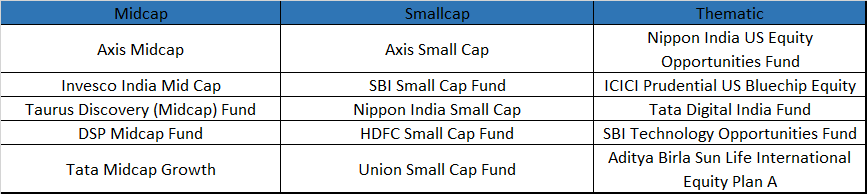

Shareholding Pattern (As on March 2020)

Source: Company Filings

- Standard Life Investments sold around 2.86% of its stake in the company on June 17 and June 18 through offer for sale

- Prashant Jain – Chief Investment Officer – offloaded his stake worth around INR 75 Crore (one third of his total stake) on June 22 and June 23

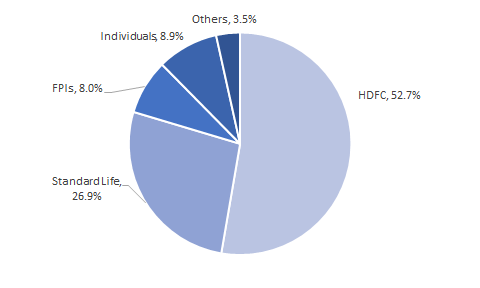

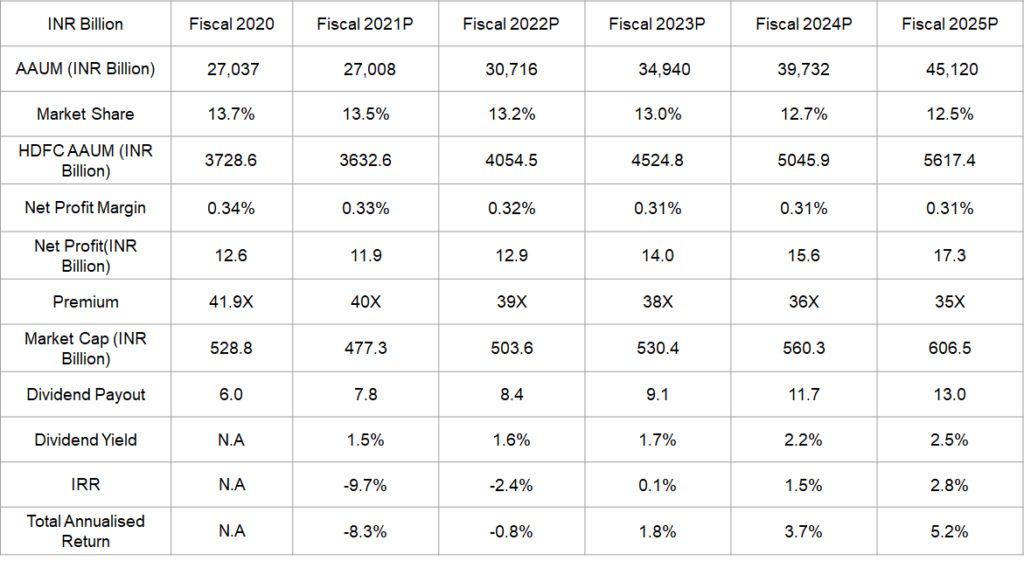

Valuation Scenario (Base Case Scenario)

Take the below numbers with a pinch of salt. On Excel Sheet, we all are billionaires

Source: Independent Research

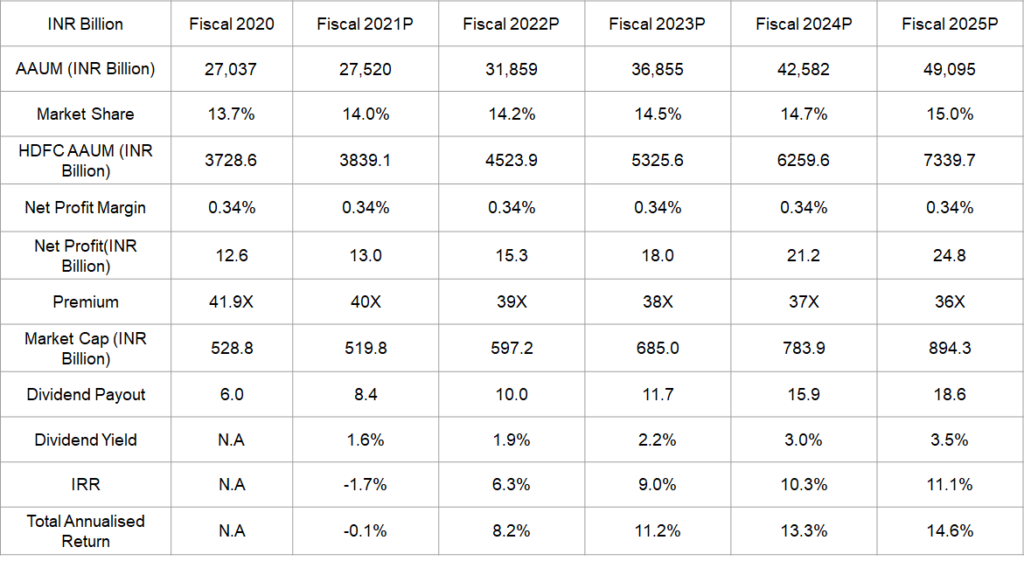

Valuation Scenario (Bear Case Scenario)

Source: Independent Research

Why you may give investing in HDFC AMC a pass

- HDFC AMC is of the most richly valued stock in financial space at ~41X Earnings

- Due to Covid-19 pandemic situation and market downturn, many smallcaps and midcaps are still available at attractive valuations which an investor may look at over HDFC AMC

- The cut-throat competition in the equity asset segment may lead to company reducing its TER thereby impacting its profitability

- Further stake sale by Standard Life Investments may put pressure on prices due to increase in float

Why you may invest in HDFC AMC

- The business is characterized by very robust and high visibility of cash flows

- The defaults in credit risk funds over last 18 months may lead to investors looking at only the top 5 players in the industry as investment vehicle; Incase of defaults, the larger AMCs are better placed to protect the interest of investors as showcased in the Essel Group default case

- Therefore in debt fund category, where investors look for capital protection rather then wealth creation, the leading players may continue to attract large % of funds

- HDFC AMC has developed strong strong distribution network and is also supported by a very strong pedigree

- Further, AMC industry is still at a nascent stage in the India with huge growth opportunity and HDFC AMC will likely ride this growth wave; the deepening of corporate bond markets will also provide impetus to its debt portfolio

- However, the positives are well- priced in, and an investor may look at HDFC AMC only as long-term portfolio stock with minimum investment tenure of 5 years

HAPPY INVESTING!

Disclaimer: The above research is provided for education purpose only and should not be construed as a call/recommendation to ‘Buy’, ‘Sell’ or ‘Hold’ the stock. The author is not a SEBI Registered Investment Advisor. Kindly refer to your financial advisor for recommendation before buying/selling any stocks or mutual funds

1 Response Comment