Core Sector data reiterates slowdown; Can further RBI Rate Cuts help revive animal spirits?

India’s Core Sector (Eight Infrastructure Industries) output registered a de-growth of 0.5% on-year basis in August 2019 further re-iterating the slowdown in the Indian Economy. The data however was not surprising given the impending slowdown in economy especially in real estate, automobile coupled with liquidity crunch (though the Industry Bodies and Government is telling us there is ample liquidity)

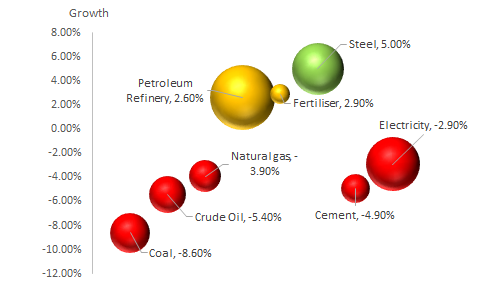

Performance of different Industries during August 2019 (on-year basis)

Note: Size of the bubble indicates the share of industry in Core Sector Index

Though the 5% growth for steel industry indicates a mild recovery, on a m-o-m basis, the industry witnessed 1% drop in index

The refinery products (28% share in index) with 2.6% growth provided some support to the index and prevented further full

Going forward in September 2019, the index might show some uptick on account of weak base of September 2018 for industries such as refinery products and Steel.

Despite the tepid core sector growth, RBI may not be aggressive with further rate cuts

RBI and Government are showing intent to work in cohesion with a common goal of promoting growth, which is not a very common phenomenon for Indian economy (whether that is positive or negative in the long-run is a topic for another day). Therefore, there is a broader sentiment prevailing that post the corporate tax cut announced by Government, RBI will also cut repo rates to further revive animal spirits. However, will RBI’s aggressive rate cut aid in reviving consumer sentiment and demand? Is liquidity in system a hindrance for growth?

The various banking reports and commentary suggest that liquidity in the system is not the single largest reason for slowdown. The economic headwinds are largely on account of disruption due to reforms such as GST and RERA, the impact of which were expedited as industry (especially unorganized segment) was already reeling under the impact of demonetization. The crisis of confidence among the financial institutions due to IL&FS fiasco and DHFL ALM mismanagement further dampened the economic sentiment.

On the demand side, the constant flurry of negative news in the financial markets certainly has an impact on the consumer mindset. The issues ranging from the wealth destruction in Yes Bank to the current issue regarding PMC bank creates a sense of insecurity among urban consumers which deters spending. In a volatile environment, a consumer will always choose to deleverage and increase his savings, thereby impeding consumption.

Therefore, we believe RBI rate cut may help little in promoting growth as the reasons for slowdown go much deeper than merely liquidity. The Government has to act swiftly to revive the activity in real estate sector. The INR 20,000 Crore announced by the Government towards affordable housing will help in dousing the crisis to some extent. However, the need of the hour is to regain trust of all stakeholders in the country’s financial system. Volatility in stock prices might be an investor’s friend, but a volatile environment does not aid consumption.

Despite all the negatives, the entire story on consumption can take a positive spin if personal income tax slabs are rationalized leading to higher disposable income.

Let us wait and watch if the Government has one more reform up its sleeve.