Advanced Enzyme – A good catalyst for portfolio growth?

Advanced Enzyme Techologies is engaged in R&D, manufacturing and marketing of proprietary products developed from indigenous enzymes.

What are Enzymes?

Enzymes are natural protein molecules produced by all living organisms, functioning as highly specialized catalysts for accelerating the pace of chemical reactions. Enzymes are responsible for many essential biochemical reactions and metabolic processes in microorganisms, plants, animals, and human beings, but are not alive. Enzymes are produced and harvested from living organisms such as plants, animals, bacteria and fungi

Global Enzyme Industry

As per industry reports, the size of the global enzyme industry was $7 billion in 2017, with share of industrial enzymes being 69%. The industry grew at 6.3% CAGR during previous five years. Going forward, it is expected to grow at 6.5% CAGR during 2017-2022 to reach market size of $9.5 billion. North America has the highest share in the global enzyme market at around 38% as of 2017, followed by Western Europe with around 25% share.

About the Company

Advanced Enzyme has more than two decades of fermentation experience in the production of enzymes and have the second highest market share domestically (next to Novozymes) . They operate in two primary business verticals namely Healthcare & Nutrition (human and animal) and Bio-Processing (food and non-food).

The company supplies its products to diverse end-user industries like human healthcare and nutrition, animal nutrition, food processing, baking, dairy and cheese processing, fruit and vegetable processing, cereal extraction, brewing, grain processing, protein processing, oil and fat processing, biomass processing, textile processing, leather processing, paper & pulp processing, bio-fuels, bio-catalysis etc.

The company has five R&D centres and seven manufacturing facilities across India and the US, with a total fermentation capacity of 420 cubic metre.

The company has 6 subsidiaries: one in US, Malaysia and Netherlands each and 3 in India. The company has a further 5 step-down subsidiaries

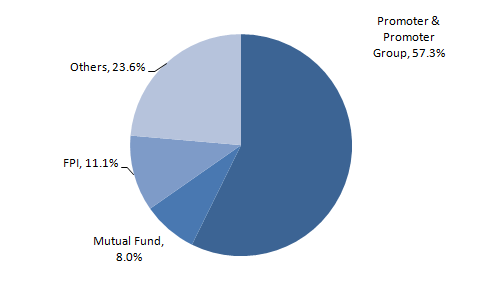

Shareholding Pattern (As of March 2019)

Source: BSE

The shareholding of Promoter Group has dropped from 67.3% in December 2018 to 57.3% in March 2019

As of March 2019, 12.5% of the total promoter shares were pledged.

A promoter entity – Chandrakant Rathi Innovations And Projects Private Limited have pledged 48.9% of its total shares as of March 2019

In the last one year, the markets have not taken kindly to promoter’s pledging their shares. Therefore, until the promoters de-pledge their shares, the ability to demand premium valuations may be limited.

A portion of pledged shares is acting as guarantee to the banks for working capital access; however, there is no absolute clarity on reason for pledge

In March 2019, OrbiMed Asia, a US -based PE firm acquired 9.9% stake in the company from promoter group at around INR 177 per share

Among the institutional investors, HDFC Small cap Fund owned 6.2% and Reliance Small Cap Fund owned 1.6%

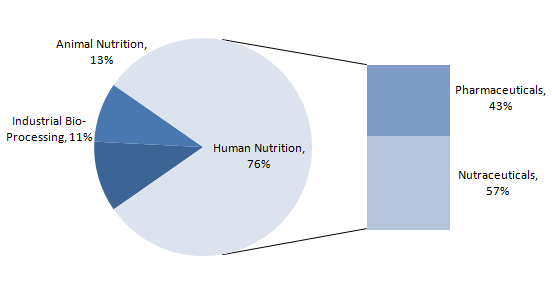

Revenue Profile – By Segments

Source: Company Filings

Human Healthcare and Nutrition

The company provides its proprietory products to various pharmaceutical and nutraceutical companies in India, North America, Europe and other countries globally.

The segment enjoys the highest margins for the company due to comparatively lower competition

Animal Nutrition

The company supplies enzyme based feed additives for the animal nutrition industry, mainly catering to poultry and swine.

Industrial Bio-Processing

Non-food segment: The company provides solutions to variety of industries such as textiles, leather, detergent and pulp and paper

Food Processing: The company caters to various food and beverage manufacturers, thereby enabling them to improve quality of products

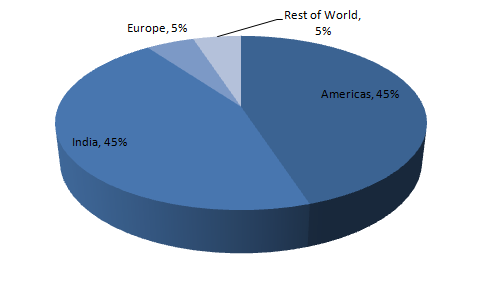

Geographic Segmentation (As of March 2019)

Source: Company Filings

The company has significant exposure to the US market and has limited headways in Europe

Further, the company generated 72% of its bottom-line from US subsidiary as of fiscal 2018; also, the company held 45% if its assets (as per book value) in the US

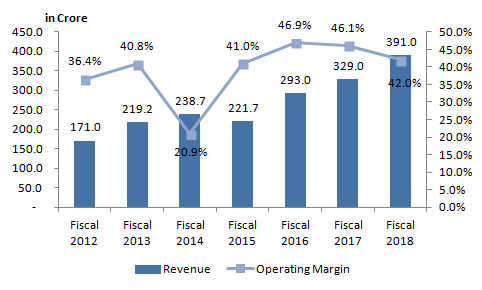

Financial Analysis

During fiscal 2013 to 2018, the sales for the company increased at 11% CAGR, with domestic and exports business growing at 11.6% CAGR and 10.5% CAGR respectively during the period

Revenue growth without margin compression

Though the company has recorded healthy operating margin, it has been volatile over last five years. This can largely be attributed to absence of long-term contracts with majority of customers and naked positions on exchange currency front

Further, the company witnessed sudden drop in operating margins to ~21% in fiscal 2014 , as the company had to recall an entire batch of products due to product contamination. The company therefore had to take a hit from one-time inventory write-off and settle customer claims

Further, in fiscal 2018 the margins dropped on account of acquisition of Evoxx Technologies, which recorded net loss of INR 14 crore during the fiscal on account of operational and foreign currency translation loss; also, the adverse movement in currency movement also impacted revenue to the tune of 4% on-year in fiscal 2018

The margins are expected to remain volatile going forward as well, since the company enters into spot contracts with its suppliers as well as customers

Company generated healthy cash flow alongwith growth in botttom-line

The company has been generating healthy PAT as well as as cash flow from operations over the years suggesting comfortable working capital cycle

The ROE however has witnessed drastic fall over the years from around 42% in fiscal 2012 to ~18% in fiscal 2018

In fiscal 2017, the company raised INR 50 Crore through IPO leading to increase in reserves and thereby impacting returns

Balance Sheet has strengthened substantially during last five years

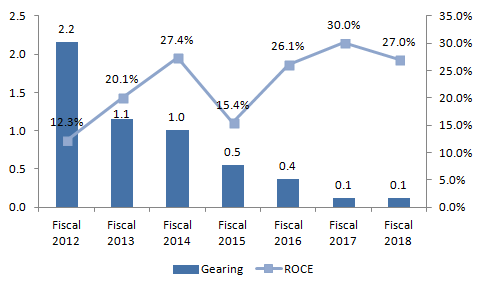

The gearing for the company has improved substantially from 2.2X in March 2012 to 0.1X in March 2018

The equity raised through IPO in fiscal 2017 and internal accruals has enabled the company to strengthen its balance sheet.

The company had no net debt as of March 2018, with total debt of INR 58 crore and cash equivalents of INR 61 crore

The company is currently operating at about 60% capacity utilisation and well paced to cater to rise in demand. The balance sheet is therefore likely to remain strong going forward as well

The receivable days and payable days were comfortable at around 55 days and 75 days respectively; however, the company maintains high inventory if measured at cost

As of March 2018, the company maintained inventory of INR 75 crore, as against COGS of around INR 81 crore

Despite the comfortable cash position and no impending capex, the company raised INR 108 crore of structured debt from Avendus Capital in May 2018. The exact structure of deal should be more clear once the company releases the 2018-19 Annual report

If part of the debt is converted into equity as part of structure, it will lead to equity dilution

Company posted healthy numbers in 9M fiscal 2019

During 9M fiscal 2019, the revenue for the company increased by around 8% CAGR to INR 311 Crore

The operating margin for the company increased by around 280 bps to 43.2%. The net profit increased by 25% on-year during the period

Acquisition of Evoxx Technologies

The company acquired 100% stake in German-based Evoxx Technologies (“Evoxx”) through cash consideration of INR 49.4 Crore, funded through internal accruals. Evoxx is an industrial biotech company focussing on the development and production of industrial enzymes to be primarly used in food applications. Evoxx has a team of around 20 scientists & technicians and 2 R&D locations in Germany

Advanced Enzyme will primarily leverage on the R&D capabilities of Evoxx to aid new product launches along-with further strengthening its Geographic footprint in Europe.

Credit Rating

The short-term credit rating for the company is CRISIL A1 and long-term rating is CRISIL A with stable outlook. For more details on rating, please click here

SWOT Analysis

Conclusion

The company looks well-poised for growth over next few years on account of its focus on R&D which will aid its product pipeline. Also, the company has enough room to ramp up it operations over next three years without undertaking capex.

At INR 192 per share (market capitalization of INR 2,150 crore), the company is currently valued at 20X FY19E earnings. Therefore, though the company is well-valued, the market assigns a higher premium to company which has presence in industry with strong entry barriers and with healthy balance sheet. In the case of Advanced Enzyme, perhaps the impending risks from margin volatiliy, pledged shares coupled with global slowdown are weighing on the company

The road ahead will depend on how the company will navigate through these risks and its ability to leverage on its acquisitions. The rewards to investors on company’s good execution may be very handsome from current price levels!

HAPPY INVESTING!!