Gilt Funds have provided superior returns during last 12-months; higher market borrowings may change this story

The Government’s decision to raise INR 12 lakh crore through market borrowings in fiscal 2021 will have a major impact on the debt markets on Monday (11th May 2020) and curb the uptrend in rising Government bond prices. The high borrowings may lead to sell-off in existing bonds and gilt funds (funds which invest in Government securities) as the new issuance’s may fetch higher yields.

The bond prices have increased over the last one year owing to expectation of a lower interest rate and a conservative borrowing target of INR 7.8 lakh crore as announced by the Finance Ministry in Union Budget 2020-21.

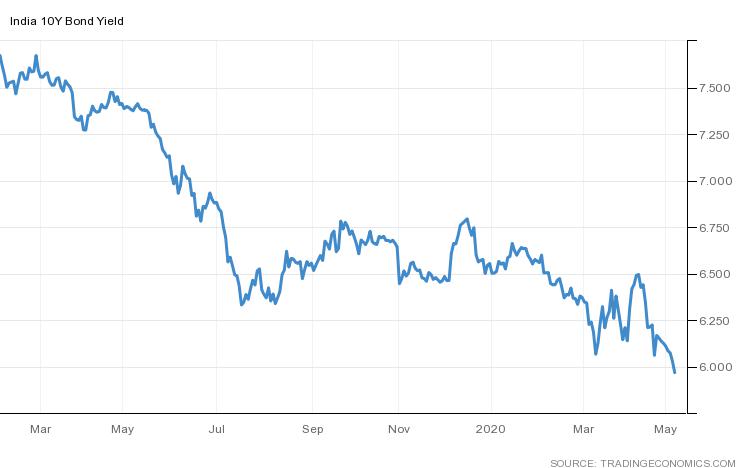

Continuous drop in yields over last 12 months

Source: RBI, TradingEconomics

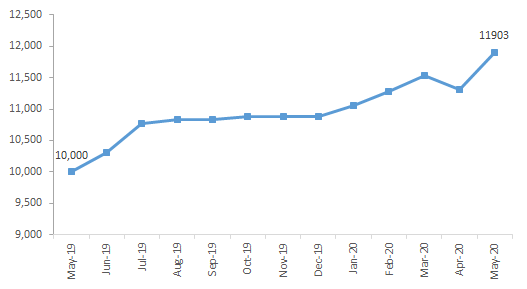

Return on Gilt Funds in last 12 months

Source: Moneycontrol

As illustrated above, SBI Magnum Gilt fund generated return of 11.9% over the last 12 months owing to softening yields. During this period, the RBI reduced the repo rate from 6.0% to 4.4%.

Though, the repo rate may further soften going forward as well by 50-75 bps, but the higher bonds issuance’s will ensure excess supply leading to softening of bond prices. Further, the expectation of a downgrade by global rating agencies due to widening fiscal deficit on account of increased market borrowings may lead to expectation of higher yields, thereby leading to sell-off in existing bonds.

At a time when the RBI is looking to reduce interest rates in the system, this is an unfavorable situation to be in. The higher yields also means higher interest rates to be paid on yield-linked products such as the Small Savings Schemes of the Government. The scenario does not mode well during a scenario where the country is looking to revive the economic through lower interest rates and fiscal stimulus.

Only Solution – Aggressive “Operation Twist”

The RBI will have to undertake more installments of ‘Operation Twist’ wherein it buys the longer-duration bonds and sells the shorter duration products. This ensures the longer duration bond-prices are protected on the downside and the yields remain soft or do not increase. The RBI had undertaken this operation in January 2020 and April 2020.

However, till what extent can RBI manage the yields through Operation Twist? The size of the operation would also determine the same. Also, a lot would depend on how global rating agencies and market participants perceive increased market borrowing

Should Investors park funds in Gilt Funds in such scenario?

The Gilt funds have generated double digit returns during last one year and therefore many investors may look at the asset class during current period of uncertainty. However, for investors with investment horizon of less than 2 years it is not advisable to invest in gilt funds. The funds are very sensitive to interest rate movements and other events such as widening fiscal deficit, downgrades/upgrades by global rating agencies, etc.

So only investors with investment horizon of more than 2 years who are looking for safety should look at gilt funds. Infact, over a 5-year period, the return of Gilt funds will most likely be significantly higher than liquid funds!

HAPPY INVESTING!