The De-rating of Rating Companies

IL&FS fiasco was arguably India’s Lehman Moment. It has now been 18 months since the turmoil began in India’s financial system, and the economy is still struggling to find its feet. Though the repercussions on the overall financial system was less contagious compared to the 2008 economic meltdown in the US, the elephant in the room again was ‘the role of Credit Rating Agencies (“CRAs”)’.

Before IL&FS defaulted on its first commercial paper in June 2018, India Ratings and Research, ICRA and CARE had given the parent company IL&FS the highest rating of AAA or AA+. In September 2018, ICRA downgraded the company by 9 notches to BB owing to liquidity crunch. The sudden and steep downgrades by CRAs after the company had already defaulted on its payments led to its scrutiny by SEBI. Further, the downgrades of DHFL by CRAs post sale of bonds by mutual funds at a discount also put light on vigilance of rating agencies.

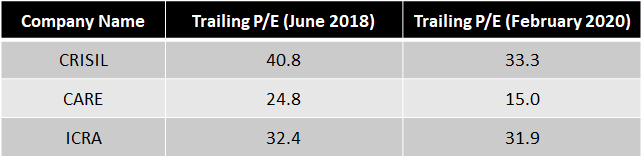

Valuation Multiples have corrected substantially for CRAs; however off its 52-week lows

The headwinds due to economic slowdown alongwith possibility of a stern action by SEBI has led to de-rating of valuation multiple of India’s top three rating since June 2018. ICRA has seen the least de-rating among the 3 major players during June 2018 to February 2019, as the stock has corrected substantially post its lows in October 2019. In case of CRISIL, the lacklustre performance of its non-rating business due to maturing norms in US and EU markets have also impacted its valuations

In June 2017, CRISIL had acquired around 8.8% stake in CARE Ratings at ~INR 435 Core, thereby valuing the company at ~INR 4,880 Crore. As on date, the market capitalization of CARE Ratings is ~INR 1,509 Crore. This showcases the amount of correction in CARE ratings over last 2 years.

MD & CEO of ICRA – Mr Naresh Takkar- was sacked in August 2019 and Mr Rajesh Mokashi – MD & CEO of CARE – was terminated from his employment in February 2020. Both CRA heads were undergoing scrutiny by their respective boards on allegations of collusion with IL&FS top management in-order to influence rating.

The industry therefore is going through a turbulent phase and many market participants are also accounting for higher penalties to ICRA and CARE for not following adequate level of due diligence while rating IL&FS. Further, there is also a possibility of further scrutiny by the regulator on the internal processes followed by the CRAs which may adversely its operations or profitability.

What Next – Will CRAs witness any structural change in their business/operational model ?

The current phase for Indian CRAs is similar to the events that characterized the economic meltdown on 2008, when the CRAs such as S&P, Fitch and Moody’s had assigned highest rating to many of the worthless Mortgaged-Backed Securities only to be downgraded later post the defaults by such securities. In a rather interesting scene in a Hollywood Blockbuster – ‘The Big Short’ – an employee of S&P asks her manager ‘Why do we continue to give AAA rating to Mortgage-Backed Securities despite their bad quality’. The reply is ‘Else they will simply go to Moody’s’.

Post the economic meltdown in the US in 2008, the role of the CRAs were thoroughly scrutinized by regulators and federal agencies. However, till date no solution has been in sight. The business continues as usual and revenue continues to come from the issuer. In fact, the share price of S&P Global (holding company of CRISIL) increased 15X post the 2008 economic meltdown till date.

Turbulent times may present good entry opportunity

There have been some suggestions and representations to the regulator post IL&FS and DHFL fiasco. However, the status-quo is likely to be maintained in the business model just as the case in US market post 2008 crisis.

CRISIL (backed by S&P Global), ICRA (backed by Moody’s) and CARE Ratings (homegrown CRA with significant shareholding of LIC and CRISIL) constitute about 90% of the market share in the Indian CRA industry. The same is likely to continue going forward as well due to its wide acceptance of its ratings by lenders. The leading players therefore enjoy a very strong moat. Deepening of the bond markets, increase in formalization of economy will further aid the growth for CRA industry.

The long-term growth prospects for the CRAs remain very strong and the top 3 players will certainly benefit from the growth of the industry. The strong cash flows, return ratios and healthy dividend yields for all the leading players will provide further comfort to investors Therefore, current correction may provide a good entry opportunity to add CRAs as a portfolio stock for long-term investors.

HAPPY INVESTING!